Last Updated:

Status:

Submitted

Review Number:

21-17

Last Updated:

Status:

Submitted

Review Number:

21-17

Last Updated:

Status:

Submitted

Review Number:

21-16

Last Updated:

Status:

Submitted

Review Number:

21-09

Last Updated:

Status:

Submitted

Review Number:

21-08

Date of Publishing:

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Report. This quarterly financial report should be read in conjunction with the 2023–24 Main Estimates.

This quarterly report has not been subject to an external audit or review.

The National Security and Intelligence Review Agency (NSIRA) is an independent external review body that reports to Parliament. Established in July 2019, NSIRA is responsible for conducting reviews of the Government of Canada’s national security and intelligence activities to ensure that they are lawful, reasonable and necessary. NSIRA also hears public complaints regarding key national security agencies and their activities.

A summary description NSIRA’s program activities can be found in Part II of the Main Estimates. Information on NSIRA’s mandate can be found on its website.

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the agency’s spending authorities granted by Parliament and those used by the agency, consistent with the 2023–24 Main Estimates. This quarterly report has been prepared using a special-purpose financial reporting framework (cash basis) designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authorities for specific purposes.

This section highlights the significant items that contributed to the net increase or decrease in authorities available for the year and actual expenditures for the quarter ended September 30, 2023.

NSIRA Secretariat spent approximately 52% of its authorities by the end of the third quarter, compared with 39% in the same quarter of 2022–23 (see graph 1).

| 2023-24 | 2022-23 | |

|---|---|---|

| Total Authorities | $24.4 | $29.8 |

| Q2 Expenditures | $4.8 | $4.7 |

| Year-to-Date Expenditures | $12.8 | $11.6 |

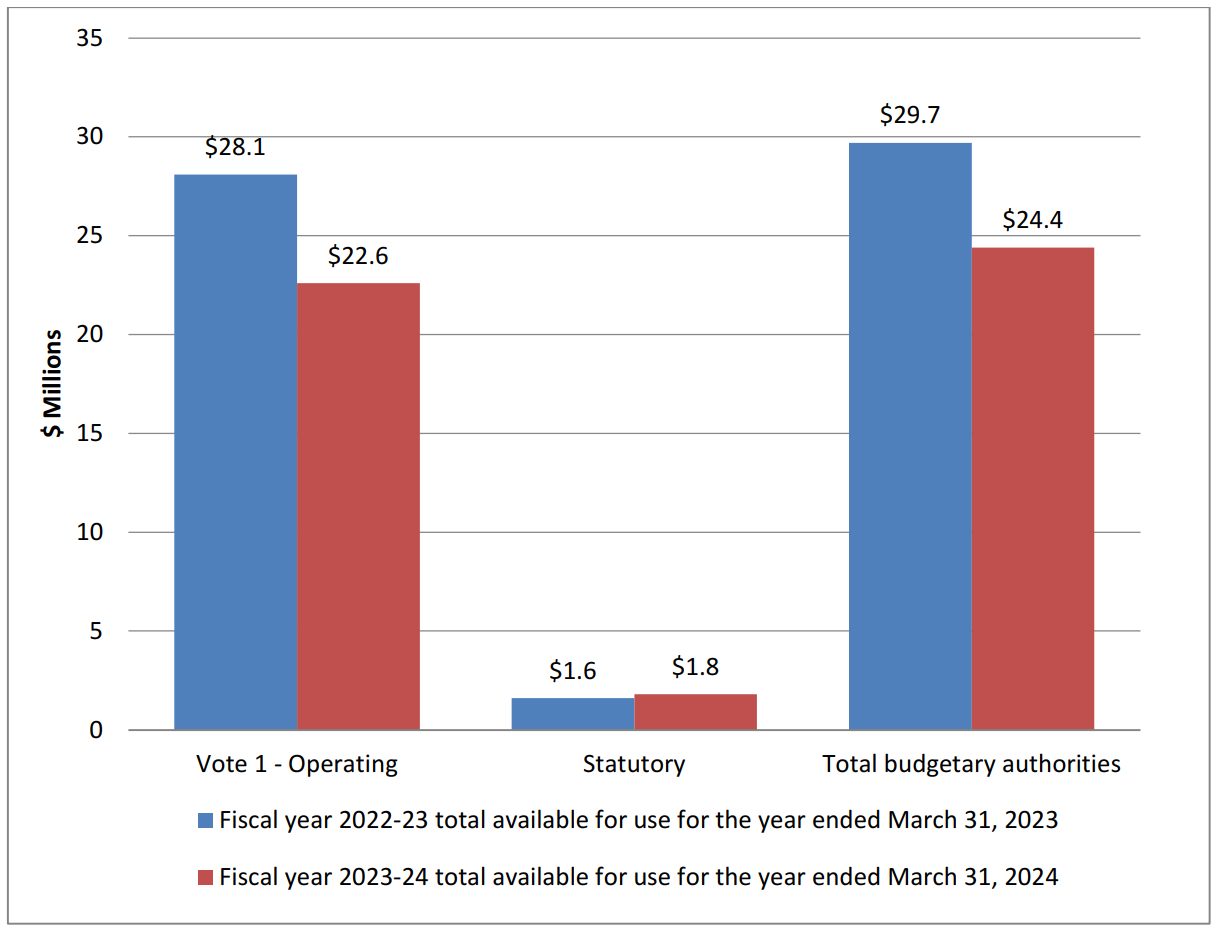

As at December 31, 2023, Parliament had approved $24.4 million in total authorities for use by NSIRA Secretariat for 2023–24 compared with $29.8 million as of December 31, 2022, for a net decrease of $5.3 million or 18% (see graph 2).

| Fiscal year 2022-23 total available for use for the year ended March 31, 2023 | Fiscal year 2023-24 total available for use for the year ended March 31, 2024 | |

|---|---|---|

| Vote 1 – Operating | 28.1 | 22.6 |

| Statutory | 1.6 | 1.8 |

| Total budgetary authorities | 29.7 | 24.4 |

The decrease of $5.3 million in authorities is mostly explained by a gradual reduction in NSIRA Secretariat’s ongoing operating funding due to an ongoing construction project nearing completion.

The third quarter expenditures totalled $4.8 million for an increase of $0.1 million when compared with $4.7 million spent during the same period in 2022–2023. Table 1 presents budgetary expenditures by standard object.

| Variances in expenditures by standard object(in thousands of dollars) | Fiscal year 2023–24: expended during the quarter ended December 31, 2023 | Fiscal year 2022–23: expended during the quarter ended December 31, 2022 | Variance $ | Variance % |

|---|---|---|---|---|

| Personnel | 2,866 | 2,503 | 363 | 15% |

| Transportation and communications | 110 | 82 | 28 | 34% |

| Information | 1 | 4 | (3) | (75%) |

| Professional and special services | 486 | 1,271 | (785) | (62%) |

| Rentals | 78 | 83 | (5) | (6%) |

| Repair and maintenance | 1,161 | 685 | 476 | 69% |

| Utilities, materials and supplies | (1) | 21 | (22) | (105%) |

| Acquisition of machinery and equipment | 83 | 2 | 81 | 4050% |

| Other subsidies and payment | (33) | 17 | (50) | (294%) |

| Total gross budgetary expenditures | 4,751 | 4,668 | 83 | 2% |

*Details may not sum to totals due to rounding*

The decrease of $785,000 is due to the timing of invoicing for our Internal Support Services agreement.

The increase of $476,000 is due to the timing of invoicing for an ongoing capital project.

The decrease of $22,000 is due to a temporarily unreconciled acquisition card suspense account.

The increase of $81,000 is due to the purchase of software licenses and the corresponding support and maintenance.

The decrease of $50,000 is explained by a prior year refund that was deposited to NSIRA’s account in error.

The year-to-date expenditures totalled $12.8 million for an increase of $1.2 million (11%) when compared with $11.6 million spent during the same period in 2022–23. Table 2 presents budgetary expenditures by standard object.

| Variances in expenditures by standard object(in thousands of dollars) | Fiscal year 2023–24: year-to-date expenditures as of December 31, 2023 | Fiscal year 2022–23: year-to-date expenditures as of December 31, 2022 | Variance $ | Variance % |

|---|---|---|---|---|

| Personnel | 8,766 | 7,751 | 1,015 | 13% |

| Transportation and communications | 302 | 196 | 106 | 54% |

| Information | 5 | 9 | (4) | (44%) |

| Professional and special services | 2,155 | 2,695 | (540) | (20%) |

| Rentals | 151 | 132 | 19 | 14% |

| Repair and maintenance | 1,188 | 749 | 439 | (59%) |

| Utilities, materials and supplies | 56 | 49 | 7 | 14% |

| Acquisition of machinery and equipment | 135 | 15 | 120 | 800% |

| Other subsidies and payment | 89 | 18 | 71 | 394% |

| Total gross budgetary expenditures | 12,847 | 11,614 | 1,233 | 11% |

*Details may not sum to totals due to rounding*

The increase of $1,015,000 relates to an increase in average salary, an increase in full time equivalent (FTE) positions, and back-pay from the new collective agreement for the EC and AS occupational groups.

The increase in $106,000 is due to the timing of the invoicing for our internet connections.

The decrease of $540,000 is mainly explained by the conclusion of guard services contracts associated to a capital construction project and the timing of invoicing for internal support services.

The increase of $439,000 is due to the timing of invoicing for an ongoing capital project.

The increase of $120,000 is mainly explained by the one-time purchase of a specialized laptop and licenses.

The increase of $71,000 is due to an increase in salary overpayments.

The NSIRA Secretariat has made progress on accessing the information required to conduct reviews; however, there continues to be risks associated with reviewees’ ability to respond to, and prioritize, information requests, hindering NSIRA’s ability to deliver its review plan in a timely way. The NSIRA Secretariat will continue to mitigate this risk by providing clear communication related to information requests, tracking their timely completion within communicated timelines, and escalating issues when appropriate.

There is a risk that the funding received to offset pay increases anticipated over the coming year will be insufficient to cover the costs of such increases and the year-over-year cost of services provided by other government departments/agencies is increasing significantly.

Mitigation measures for the risks outlined above have been identified and are factored into NSIRA Secretariat’s approach and timelines for the execution of its mandated activities

There have been no changes to the NSIRA Secretariat Program.

John Davies

Executive Director

Martyn Turcotte

Director General, Corporate Services, Chief Financial Officer

(in thousands of dollars)

| Fiscal year 2023–24 | Fiscal year 2022–23 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2024 (note 1) | Used during the quarter ended December 31, 2023 | Year to date used at quarter-end | Total available for use for the year ending March 31, 2023 (note 1) | Used during the quarter ended December 31, 2022 | Year to date used at quarter-end | |

| Vote 1 – Net operating expenditures | 22,633 | 4,313 | 11,531 | 28.063 | 4,236 | 10,318 |

| Budgetary statutory authorities | ||||||

| Contributions to employee benefit plans | 1,755 | 438 | 1,316 | 1,728 | 432 | 1,296 |

| Total budgetary authorities (note 2) | 24,388 | 4,751 | 12,847 | 29,791 | 4,668 | 11,614 |

Note 1: Includes only authorities available for use and granted by Parliament as at quarter-end.

Note 2: Details may not sum to totals due to rounding.

(in thousands of dollars)

| Fiscal year 2023–24 | Fiscal year 2022–23 | |||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2024 (note 1) | Expended during the quarter ended December 31, 2023 | Year to date used at quarter-end | Planned expenditures for the year ending March 31, 2023 | Expended during the quarter ended December 31, 2022 | Year to date used at quarter-end | |

| Expenditures | ||||||

| Personnel | 13,372 | 2,866 | 8,766 | 13,389 | 2,503 | 7,751 |

| Transportation and communications | 650 | 110 | 302 | 597 | 82 | 196 |

| Information | 371 | 1 | 5 | 372 | 4 | 9 |

| Professional and special services | 4,906 | 486 | 2,155 | 4,902 | 1,271 | 2,695 |

| Rentals | 271 | 78 | 151 | 271 | 83 | 132 |

| Repair and maintenance | 4,580 | 1,161 | 1,188 | 9,722 | 685 | 749 |

| Utilities, materials and supplies | 73 | (1) | 56 | 173 | 21 | 49 |

| Acquisition of machinery and equipment | 132 | 83 | 135 | 232 | 2 | 15 |

| Other subsidies and payments | 33 | (33) | 89 | 133 | 17 | 18 |

| Total gross budgetary expenditures (note 2) |

24,388 | 4,751 | 12,847 | 29,791 | 4,668 | 11,614 |

Note 1: Includes only authorities available for use and granted by Parliament as at quarter-end.

Note 2: Details may not sum to totals due to rounding.

In 2021, the National Security and Intelligence Review Agency (NSIRA) began its review of the Canada Border Services Agency’s (CBSA) Confidential Human Source Program, building upon earlier work by the National Security and Intelligence Committee of Parliamentarians (NSICOP) in this area. While CBSA had been the subject of previous NSIRA reviews, this marked one of NSIRA’s first in-depth reviews specifically focused on CBSA activities.

CBSA’s mandate in national security and intelligence is extensive and complex. In this review, NSIRA focused on the use of confidential human sources, an activity that carries inherent risks. These risks encompass not only the safety and security of the individuals operating as human sources, but also the broader implications of managing such a program. CBSA has operated its human source program since 1984, but it wasn’t until 2014 that formal policies and standard operating procedures were established. Operating for decades without a formal, documented framework significantly heightened these risks.

This CBSA review was part of a broader series of three NSIRA reviews, with the others focusing on the Royal Canadian Mounted Police (RCMP) and the source handling operations of the Department of Defence/ Canadian Armed Forces (DND/CAF) human source programs. All three reviews addressed critical issues: managing and assessing risks, ensuring the welfare of sources, and ensuring proper ministerial direction and accountability. These areas are essential for ensuring that human source programs are accountable, lawful, and ethical.

The review found that CBSA’s human source program, as an investigative tool supporting its mandate, operates within a legally sound framework. However, it identified several gaps in the program’s governance, and in two cases, raised concerns about potential legal non-compliance.

NSIRA made six recommendations to strengthen the governance of the human source program. These recommendations stress the importance of prioritizing the safety and well-being of human sources in all aspects of CBSA operations. They also reinforce NSIRA’s ongoing commitment to ministerial accountability. Overall, the findings and recommendations reflect the continued development of CBSA’s human source program. Although the program has been in place for nearly 40 years, the introduction of formal policies governing human sources is a more recent change, and the review highlights CBSA’s ongoing efforts to improve the program’s governance and operations.

ISSN: 2817-7525

This report presents findings and recommendations made in NSIRA’s annual review of disclosures of information under the Security of Canada Information Disclosure Act (SCIDA). It was tabled in Parliament by the Minister of Public Safety, as required under subsection 39(2) of the NSIRA Act, on November 1st, 2023.

The SCIDA provides an explicit, stand-alone authority to disclose information between Government of Canada institutions in order to protect Canada against activities that undermine its security. Its stated purpose is to encourage and facilitate such disclosures.

This report provides an overview of the SCIDA’s use in 2022. In doing so, it:

The report contains six recommendations designed to increase standardization across the Government of Canada in a manner that is consistent with institutions’ demonstrated best practices and the SCIDA’s guiding principles.

Date of Publishing:

Our team is working on an HTML version of this content to enhance usability and compatibility across devices. We aim to make it available in the near future. Thank you for your patience!

Last Updated:

Status:

Published

Review Number:

21-04

In 2021, NSIRA began its review of the Communications Security Establishment’s (CSE) use of the polygraph for security screening. This review also explored the Treasury Board Secretariat’s (TBS) role in including the polygraph in the Standard on Security Screening introduced in 2014.

The Government of Canada has used the polygraph as a tool for security screening since the Cold War. When the Canadian Security Intelligence Service (CSIS) started using the polygraph in 1984, its then-review body, the Security Intelligence Review Committee (SIRC), criticized its use in screening the thousands of Canadians CSIS employs. SIRC specifically questioned the science behind the polygraph as a legitimate, effective, and fair means to judge the loyalty of Canadians, as well as the justification for the general application of what is seen as a highly invasive tool.

In 2019, NSIRA completed a review of CSIS’s Internal Security Branch, which included CSIS’s use of the polygraph for security screening. In that review, NSIRA found several shortcomings with the CSIS program, including:

At CSE, NSIRA found many of the same or strikingly similar shortcomings.

NSIRA’s priority in conducting this review was always clear: to evaluate whether the privacy and Charter rights of CSE’s employees and prospective employees were being protected. As this report demonstrates, NSIRA found that in some cases, they were not.

The Government of Canada is responsible for safeguarding its employees, information, and assets. Threats to Canada and Canadians are real. Security screening is the primary way the government determines an individual’s loyalty to Canada before entrusting them with access to sensitive information or facilities required to carry out their duties as public servants.

NSIRA’s review of CSE’s use of the polygraph for security screening is important because it is the first time an independent review body in Canada has assessed such a program with this level of operational detail and scrutiny.

From the outset, NSIRA determined that this review could not be completed without being able to assess the actual conduct of polygraph exams, with appropriate protections in place to protect the anonymity of the individuals submitting to the exam. As demonstrated by this report, access to these recordings was, in fact, fundamental to many of NSIRA’s findings.

This review is also timely as TBS reviews and updates the 2014 Security Screening Standard. The importance of security screening should prompt TBS to undertake a thorough analysis to support which screening tools it promotes and requires while being mindful that security screening does not grant an organization the license to override the fundamental privacy protections granted under Canadian law.

The government now has an opportunity to correct past errors and conduct the fulsome assessment and analysis required to rigorously explore whether using the polygraph for security screening is justified. We trust that the government will consider our findings and recommendations, which may be informative as TBS completes these long-overdue updates.