- Statement of Management Responsibility Including Internal Control over Financial Reporting

- Statement of Financial Position (Unaudited)

- Statement of Operations and Departmental Net Financial Position (Unaudited)

- Statement of Change in Departmental Net Debt (Unaudited)

- Statement of Cash Flows (Unaudited)

- Notes to the Financial Statements (Unaudited)

- 1. Authority and objectives

- 2. Summary of significant accounting policies

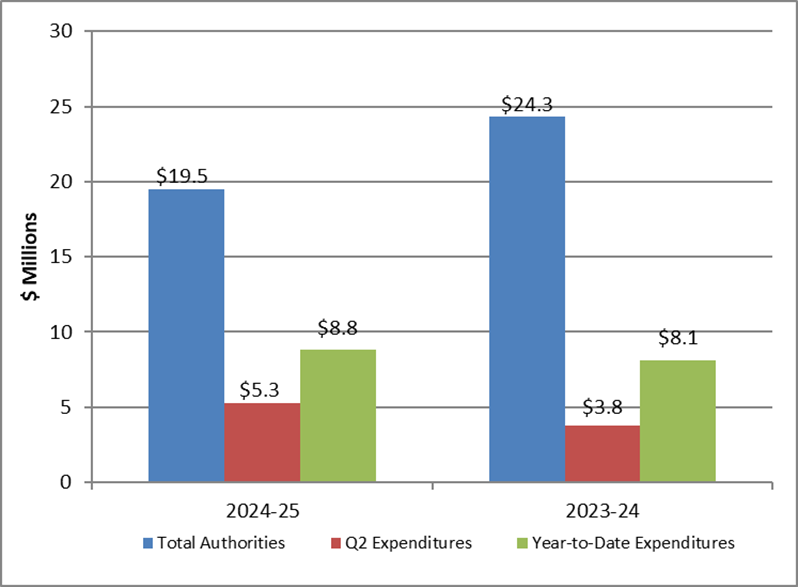

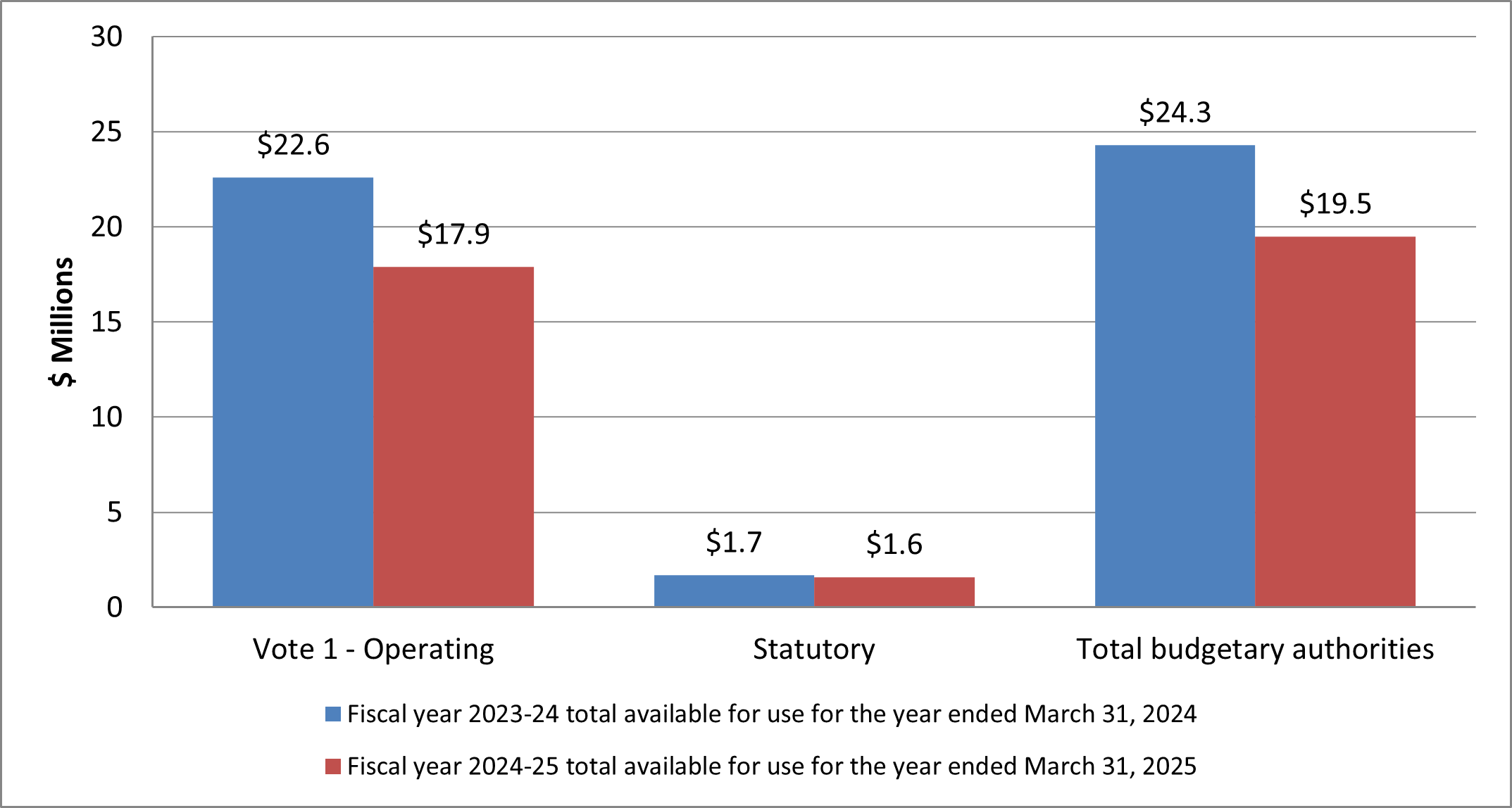

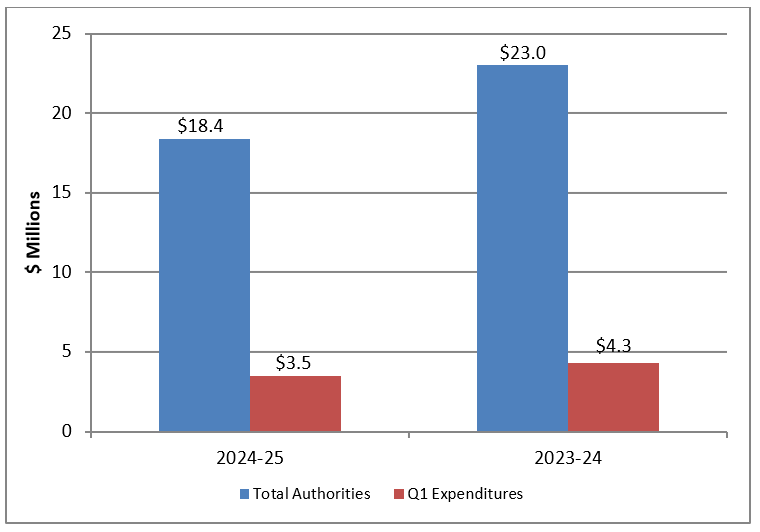

- 3. Parliamentary authorities

- 4. Accounts payable and accrued liabilities

- 5. Employee future benefits

- 6. Accounts receivable and advances

- 7. Tangible capital assets

- 8. Contractual obligations

- 9. Related party transactions

- 10. Segmented information

- Annex to the Statement of Management Responsibility Including Internal Control over Financial Reporting for Fiscal Year 2021-22 (unaudited)

Date of Publishing:

Statement of Management Responsibility Including Internal Control over Financial Reporting

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2024, and all information contained in these financial statements rests with the management of the National Security and Intelligence Review Agency (NSIRA) Secretariat. These financial statements have been prepared by management using the Government of Canada’s accounting policies, which are based on Canadian public sector accounting standards.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management’s best estimates and judgment and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the NSIRA Secretariat’s financial transactions. Financial information submitted in the preparation of the Public Accounts of Canada, and included in the NSIRA Secretariat’s Departmental Results Report, is consistent with these financial statements.

Management is also responsible for maintaining an effective system of internal control over financial reporting (ICFR) designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are properly authorized and recorded in accordance with the Financial Administration Act and other applicable legislation, regulations, authorities, and policies.

Management seeks to ensure the objectivity and integrity of data in its financial statements through careful selection, training and development of qualified staff; through organizational arrangements that provide appropriate divisions of responsibility; through communication programs aimed at ensuring that regulations, policies, standards, and managerial authorities are understood throughout the NSIRA Secretariatand through conducting an annual risk-based assessment of the effectiveness of the system of ICFR.

The system of ICFR is designed to mitigate risks to a reasonable level based on an ongoing process to identify key risks, to assess effectiveness of associated key controls, and to make any necessary adjustments.

The NSIRA Secretariat will be subject to periodic Core Control Audits performed by the Office of the Comptroller General and will use the results of such audits to adhere to the Treasury Board Policy on Financial Management. In the interim, the NSIRA Secretariat has undertaken a risk-based assessment of the system of ICFR for the year ended March 31, 2024, in accordance with the Treasury Board Policy on Financial Management, and the action plan is summarized in the simplified annex.

The financial statements of the National Security and Intelligence Review Agency Secretariat have not been audited.

Charles Fugère

Executive Director

Martyn Turcotte

Director General, Corporate Services and Chief Financial Officer

Ottawa, Canada

September 6, 2024

Statement of Financial Position (Unaudited)

As of March 31 (in thousands of dollars)

| 2024 | 2023 | |

|---|---|---|

| Liabilities | ||

| Accounts payable and accrued liabilities (Note 4) | 1,669 | 1,433 |

| Vacation pay and compensatory leave | 495 | 632 |

| Employee future benefits (Note 5b) | 212 | 229 |

| Total liabilities | 2,376 | 2,294 |

| Financial assets | ||

| Due from Consolidated Revenue Fund | 1,470 | 1,000 |

| Accounts receivable and advances (Note 6) | 309 | 518 |

| Total net financial assets | 1,779 | 1,518 |

| Departmental net debt | 597 | 776 |

| Non-financial assets | ||

| Prepaid expenses | 61 | 6 |

| Tangible capital assets (Note 7) | 7,331 | 4,824 |

| Total non-financial assets | 7,392 | 4,830 |

| Departmental net financial position | 6,795 | 4,054 |

| Contractual obligations (Note 8) | ||

The accompanying notes form an integral part of these financial statements.

Charles Fugère

Executive Director

Martyn Turcotte

Director General, Corporate Services and Chief Financial Officer

Ottawa, Canada

September 12, 2023

Statement of Operations and Departmental Net Financial Position (Unaudited)

For the Year Ended March 31 (in thousands of dollars)

| 2024 Planned Results |

2024 Actual | 2023 Actual | |

|---|---|---|---|

| Expenses | |||

| NSIRA Secretariat Reviews and Complaints Investigations (Note 10) | 10,807 | 9,594 | 8,359 |

| Internal Services (Note 10) | 12,202 | 8,629 | 11,227 |

| Total expenses | 23,009 | 18,223 | 19,586 |

| Net cost from continuing operations | 23,009 | 18,223 | 19,586 |

| Net cost of operations before government funding and transfers | 23,009 | 18,223 | 19,586 |

| Government funding and transfers | |||

| Net cash provided by Government of Canada | 19,061 | 17,929 | |

| Change in due from Consolidated Revenue Fund | 470 | 308 | |

| Services provided without charge by other government departments (Note 9a) | 1,437 | 1,265 | |

| Transfer of overpayments | (4) | 9 | |

| Net cost of operations after government funding and transfers | – | (2,741) | 75 |

| Departmental net financial position – Beginning of year | – | 4,054 | 4,129 |

| Departmental net financial position – End of year | – | 6,795 | 4,054 |

Segmented information (Note 11)

The accompanying notes form an integral part of these financial statements.

Statement of Change in Departmental Net Debt (Unaudited)

For the Year Ended March 31 (in thousands of dollars)

| 2024 Actual | 2023 Actual | |

|---|---|---|

| Net cost of operations after government funding and transfers | (2,741) | 75 |

| Change due to tangible capital assets | ||

| Acquisition of tangible capital assets (Note 7) | 2,822 | 755 |

| Amortization of tangible capital assets (Note 7) | (315) | (664) |

| Total change due to tangible capital assets | 2,507 | 91 |

| Change due to prepaid expenses | 55 | (65) |

| Net increase (decrease) in departmental net debt | (179) | 101 |

| Departmental net debt – Beginning of year | 776 | 675 |

| Departmental net debt – End of year | 597 | 776 |

The accompanying notes form an integral part of these financial statements.

Statement of Cash Flows (Unaudited)

For the Year Ended March 31 (in thousands of dollars)

| 2024 | 2023 | |

|---|---|---|

| Operating activities | ||

| Net cost of operations before government funding and transfers | 18,223 | 19,586 |

| Non-cash items: | – | – |

| Amortization of tangible capital assets | (315) | (664) |

| Services provided without charge by other government departments (Note 9a) | (1,437) | (1,265) |

| Transfer of overpayments | 4 | (9) |

| Variations in Statement of Financial Position: | – | – |

| Increase (decrease) in accounts receivable and advances | (209) | (119) |

| Increase (decrease) in prepaid expenses | 55 | (65) |

| Decrease (increase) in accounts payable and accrued liabilities | (236) | (213) |

| Decrease (increase) in vacation pay and compensatory leave | 137 | (76) |

| Decrease (increase) in future employee benefits | 17 | (1) |

| Cash used in operating activities | 16,239 | 17,174 |

| Capital investing activities | – | – |

| Acquisitions of tangible capital assets (Note 7) | 2,822 | 755 |

| Cash used in capital investing activities | 2,822 | 755 |

| Net cash provided by Government of Canada | 19,061 | 17,929 |

Notes to the Financial Statements (Unaudited)

1. Authority and objectives

NSIRA, and the NSIRA Secretariat, were both established, effective July 12, 2019, under the National Security and Intelligence Review Agency Act (NSIRA Act).

The NSIRA Secretariat is a division of the federal public administration as set out in column 1 of Schedule I.1 of the Financial Administration Act whose appropriate minister is the Prime Minister.

One mandate of NSIRA is to review Government of Canada national security and intelligence activities to assess whether they are lawful, reasonable, and necessary. NSIRA also has a quasi-judicial mandate; it investigates complaints from members of the public on the activities of the Canadian Security Intelligence Service (CSIS), the Communications Security Establishment (CSE), the Royal Canadian Mounted Police (RCMP), as well as certain other national security-related complaints. The NSIRA Secretariat’s role is to assist NSIRA in fulfilling its mandate.

To achieve its strategic outcome and deliver results for Canadians, NSIRA Secretariat articulates its plans and priorities based on the core responsibility and program inventory included below:

National Security and Intelligence Reviews and Complaints Investigations

The NSIRA Secretariat supports the Agency in the delivery of its mandate. Independent scrutiny contributes to strengthening the accountability framework for national security and intelligence activities and to enhancing public confidence. Ministers and Canadians are informed whether national security and intelligence activities undertaken by Government of Canada institutions are lawful, reasonable, and necessary.

Internal Services

Internal support services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization. These groups are: Management and Oversight Services; Communications Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; Acquisition Services; and Other Administrative Services. Internal Services include only those activities and resources that apply across an organization and not to those provided specifically to a program.

2. Summary of significant accounting policies

These financial statements are prepared using NSIRA Secretariat’s accounting policies stated below, which are based on Canadian public sector accounting standards. The presentation and results using the stated accounting policies do not result in any significant differences from Canadian public sector accounting standards.

Significant accounting policies are as follows:

(a) Parliamentary authorities

NSIRA Secretariat is financed by the Government of Canada through Parliamentary authorities. Financial reporting of authorities provided to NSIRA Secretariat do not parallel financial reporting according to generally accepted accounting principles since authorities are primarily based on cash flow requirements. Consequently, items recognized in the Statement of Operations and Departmental Net Financial Position and in the Statement of Financial Position are not necessarily the same as those provided through authorities from Parliament.

Note 3 provides a reconciliation between the bases of reporting. The planned results amounts in the ”Expenses” and ”Revenues” sections of the Statement of Operations and Departmental Net Financial Position are the amounts reported in the Future-Oriented Statement of Operations included in the 2023-2024 Departmental Plan. The planned results amounts in the “Government funding and transfers” section of the Statement of Operations and Departmental Net Financial Position and in the Statement of Change in Departmental Net Debt were prepared for internal management purposes and have not been previously published.

(b) Net cash provided by Government of Canada

NSIRA Secretariat operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by NSIRA Secretariat is deposited to the CRF, and all cash disbursements made by NSIRA Secretariat are paid from the CRF. The net cash provided by Government is the difference between all cash receipts and all cash disbursements, including transactions between departments of the Government.

(c) Amounts due from or to the CRF

Amounts due from or to the CRF are the result of timing differences at year-end between when a transaction affects authorities and when it is processed through the CRF. Amounts due from the CRF represent the net amount of cash that NSIRA Secretariat is entitled to draw from the CRF without further authorities to discharge its liabilities.

(d) Expenses

- Vacation pay and compensatory leave are accrued as the benefits are earned by employees under their respective terms of employment.

- Services provided without charge by other government departments for accommodation, employer contributions to the health and dental insurance plans and workers’ compensation are recorded as operating expenses at their carrying value.

(e) Employee future benefits

- Pension benefits: Eligible employees participate in the Public Service Pension Plan, a pension plan administered by the Government. NSIRA’s contributions to the Plan are charged to expenses in the year incurred and represent the total departmental obligation to the Plan. NSIRA’s responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the Plan’s sponsor.

- Severance benefits: The accumulation of severance benefits for voluntary departures ceased for applicable employee groups. The remaining obligation for employees who did not withdraw benefits is calculated using information derived from the results of the actuarially determined liability for employee severance benefits for the Government as a whole.

(f) Non-financial assets

All tangible capital assets having an initial cost of $10,000 or more are recorded at their acquisition cost. Tangible capital assets do not include immovable assets located on reserves as defined in the Indian Act, works of art, museum collection and Crown land to which no acquisition cost is attributable; and intangible assets.

Inventories are valued at cost and are comprised of spare parts and supplies held for future program delivery and are not primarily intended for resale. Inventories that no longer have service potential are valued at the lower of cost or net realizable value.

(g) Measurement uncertainty

The preparation of these financial statements requires management to make estimates and assumptions that affect the reported and disclosed amounts of assets, liabilities, revenues and expenses reported in the financial statements and accompanying notes at March 31. The estimates are based on facts and circumstances, historical experience, general economic conditions and reflect the Government’s best estimate of the related amount at the end of the reporting period. The most significant items where estimates are used are contingent liabilities, the liability for employee future benefits and the useful life of tangible capital assets.

Actual results could significantly differ from those estimated. Management’s estimates are reviewed periodically and, as adjustments become necessary, they are recorded in the financial statements in the year they become known.

(h) Related party transactions

Related party transactions, other than inter-entity transactions, are recorded at the exchange amount.

Inter-entity transactions are transactions between commonly controlled entities. Inter-entity transactions, other than restructuring transactions, are recorded on a gross basis and are measured at the carrying amount, except for the following:

- Services provided on a recovery basis are recognized as revenues and expenses on a gross basis and measured at the exchange amount.

- Certain services received on a without charge basis are recorded for departmental financial statement purposes at the carrying amount.

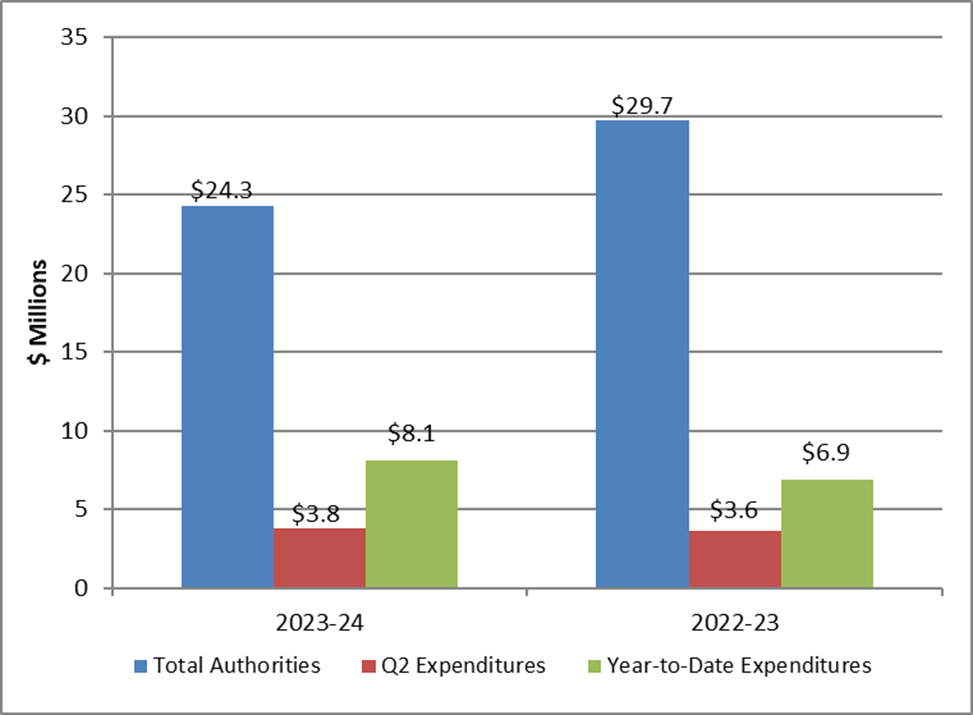

3. Parliamentary authorities

NSIRA Secretariat receives most of its funding through annual Parliamentary authorities. Items recognized in the Statement of Operations and Departmental Net Financial Position and the Statement of Financial Position in one year may be funded through Parliamentary authorities in prior, current, or future years. Accordingly, NSIRA Secretariat has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in the following tables:

(a) Reconciliation of net cost of operations to current year authorities used

(in thousands of dollars)

| 2024 | 2023 | |

|---|---|---|

| Net cost of operations before government funding and transfers | 18,223 | 19,586 |

| Adjustments for items affecting net cost of operations but not affecting authorities: | ||

| Amortization of tangible capital assets | (315) | (664) |

| Services provided without charge by other government departments | (1,437) | (1,265) |

| Increase / (decrease) in vacation pay and compensatory leave | 137 | (76) |

| Increase / (decrease) in employee future benefits | 17 | (1) |

| Refund of prior years’ expenditures | 102 | 6 |

| Total items affecting net cost of operations but not affecting authorities | (1,496) | (2,000) |

| Adjustments for items not affecting net cost of operations but affecting authorities | ||

| Acquisition of tangible capital assets | 2,822 | 755 |

| Increase / (decrease) in prepaid expenses | 55 | (65) |

| Accounts receivable and advances | 42 | 13 |

| Total items not affecting net cost of operations but affecting authorities | 2,919 | 703 |

| Current year authorities used | 19,646 | 18,289 |

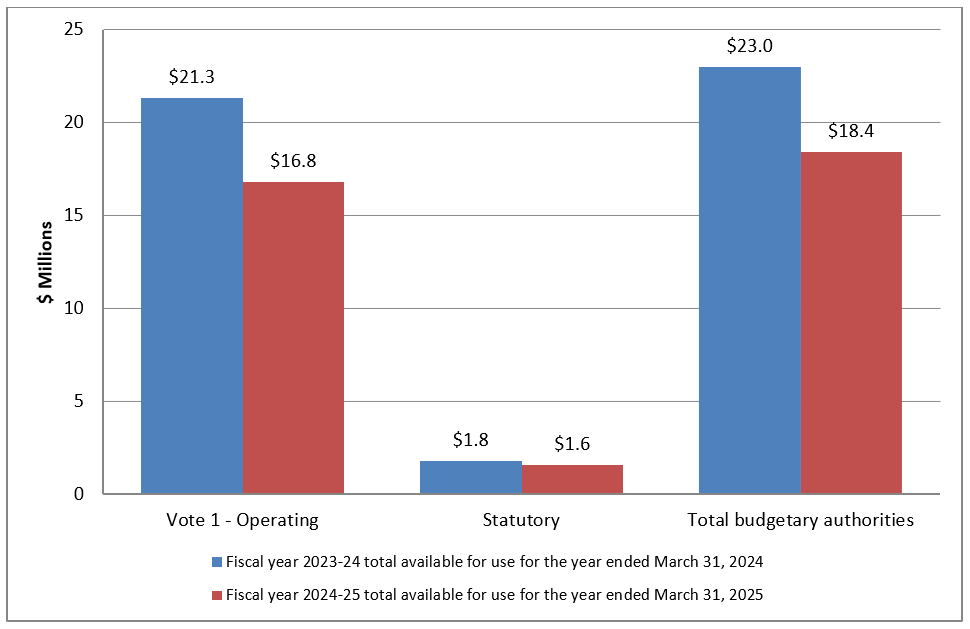

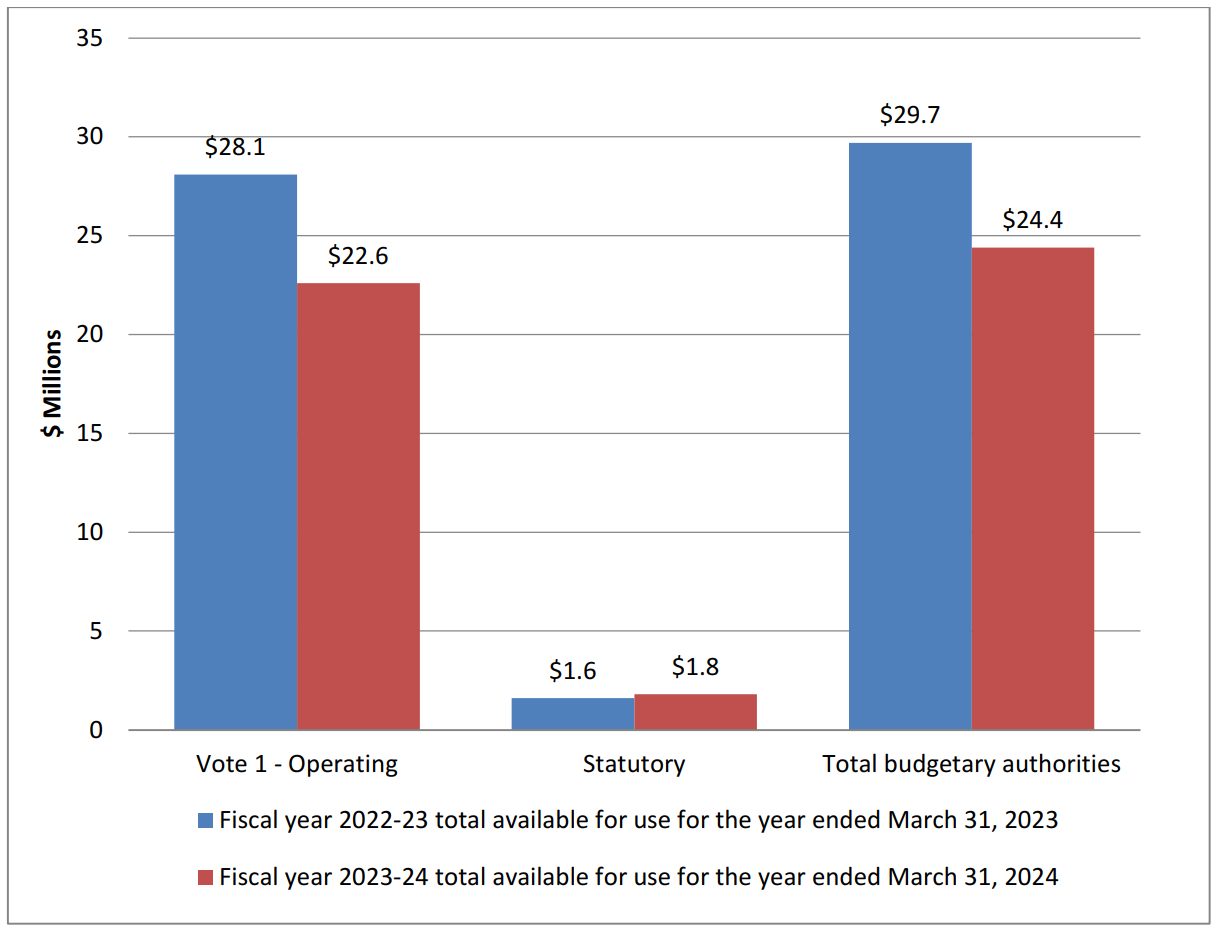

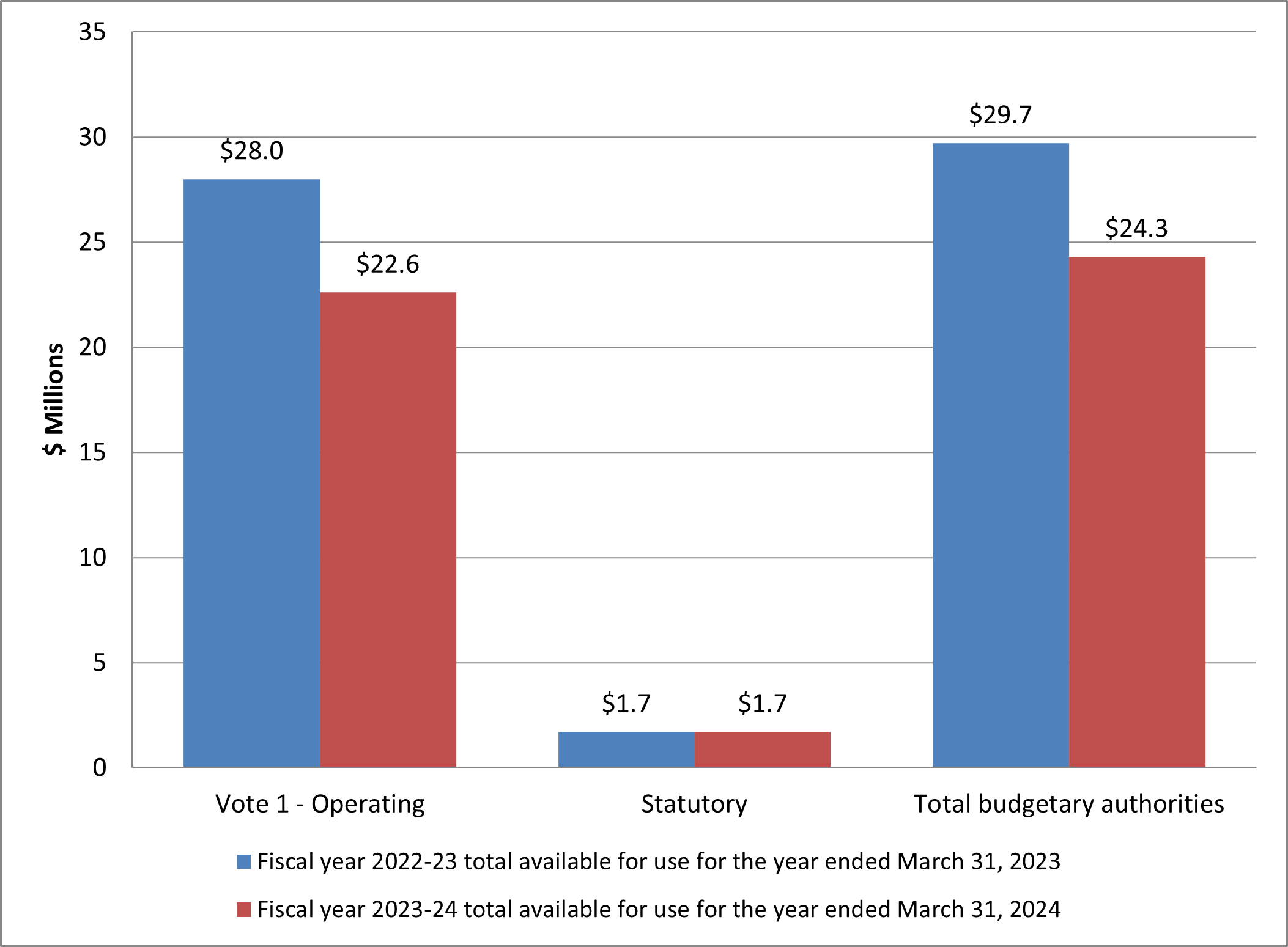

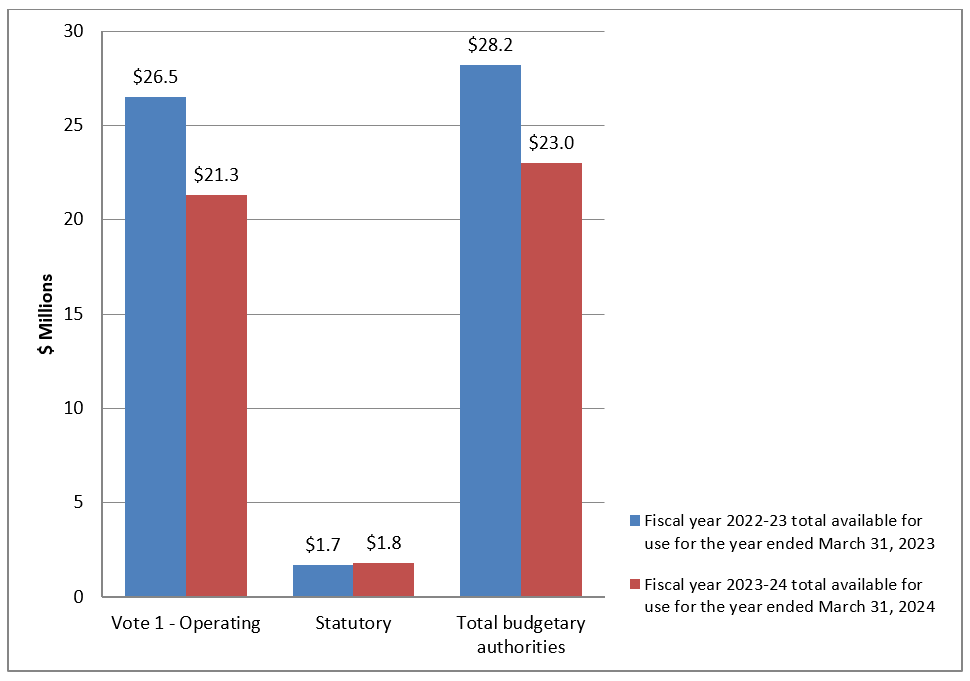

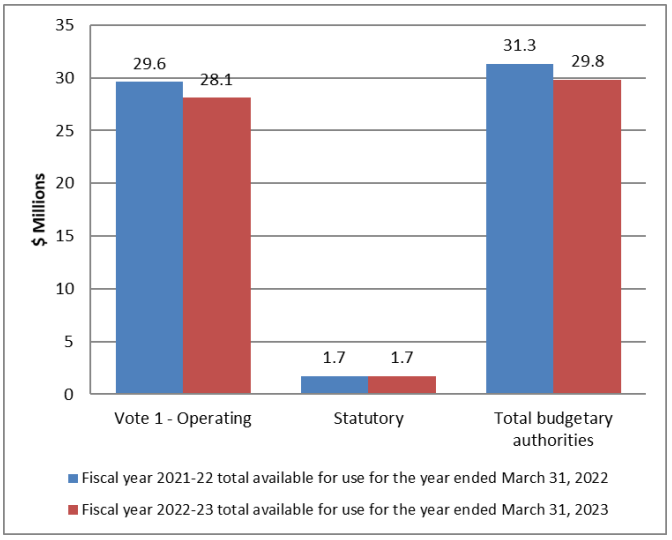

(b) Authorities provided and used

(in thousands of dollars)

| 2024 | 2023 | |

|---|---|---|

| Authorities provided: | ||

| Vote 1 – Operating expenditures | 22,633 | 28,074 |

| Statutory amounts | 1,558 | 1,300 |

| Less: | ||

| Lapsed: Operating | (4,545) | (11,085) |

| Current year authorities used | 19,646 | 18,289 |

4. Accounts payable and accrued liabilities

The following table presents details of NSIRA’s accounts payable and accrued liabilities.

(in thousands of dollars)

| 2024 | 2023 | |

|---|---|---|

| Accounts payable – Other government departments and agencies | 429 | 425 |

| Accounts payable – External parties | 1,240 | 1,008 |

| Total accounts payable | 1,669 | 1,433 |

| Total accounts payable and accrued liabilities | 1,669 | 1,433 |

5. Employee future benefits

(a) Pension benefits

NSIRA Secretariat’s employees participate in the Public Service Pension Plan (the ”Plan”), which is sponsored and administered by the Government of Canada. Pension benefits accrue up to a maximum period of 35 years at a rate of two percent per year of pensionable service, times the average of the best five consecutive years of earnings. The benefits are integrated with Canada/Québec Pension Plan benefits, and they are indexed to inflation.

Both the employees and the NSIRA Secretariat contribute to the cost of the Plan. Due to the amendment of the Public Service Superannuation Act following the implementation of provisions related to Economic Action Plan 2012, employee contributors have been divided into two groups – Group 1 related to existing plan members as of December 31, 2012, and Group 2 relates to members joining the Plan as of January 1, 2013. Each group has a distinct contribution rate.

The 2023-24 expense amounts to $1,393,438 ($1,178,731 in 2022-23). For Group 1 members, the expense represents approximately 1.02 times (1.02 times in 2022-23) the employee contributions and, for Group 2 members, approximately 1.00 times (1.00 times in 2022-23) the employee contributions.

NSIRA Secretariat’s responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the Consolidated Financial Statements of the Government of Canada, as the Plan’s sponsor.

(b) Severance benefits

Severance benefits provided to NSIRA Secretariat’s employees were previously based on an employee’s eligibility, years of service and salary at termination of employment. However, since 2011 the accumulation of severance benefits for voluntary departures progressively ceased for substantially all employees. Employees subject to these changes were given the option to be paid the full or partial value of benefits earned to date or collect the full or remaining value of benefits upon departure from the public service. By March 31, 2024, substantially all settlements for immediate cash out were completed. Severance benefits are unfunded and, consequently, the outstanding obligation will be paid from future authorities.

The changes in the obligations during the year were as follows:

(in thousands of dollars)

| 2024 | 2023 | |

|---|---|---|

| Accrued benefit obligation – Beginning of year | 229 | 228 |

| Expense for the year | 21 | 1 |

| Benefits paid during the year | (38) | – |

| Accrued benefit obligation – End of year | 212 | 229 |

6. Accounts receivable and advances

The following table presents details of NSIRA’s accounts receivable and advances balances:

| 2024 | 2023 | |

|---|---|---|

| Receivables – Other government departments and agencies | 237 | 454 |

| Receivables – External parties | 49 | 40 |

| Employee advances | 23 | 24 |

| Net accounts receivable | 309 | 518 |

7. Tangible capital assets

Amortization of tangible capital assets is done on a straight-line basis over the estimated useful life of the asset as follows:

| Asset Class | Amortization Period |

|---|---|

| Informatics hardware | 3 to 10 years |

| Other equipment | 3 to 30 years |

| Leasehold improvements | Over the useful life of the improvement or the lease term, whichever is shorter |

(in thousands of dollars)

| Cost | Accumulated Amortization | Net Book Value | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) Adjustments include assets under construction that were transferred to the other categories upon completion of the assets. | ||||||||||||

| Capital Asset Class | Opening Balance | Acquisitions | Adjustments (1) | Disposal and Write-Offs | Closing Balance | Opening Balance | Amortization | Adjustments (1) | Disposals and Write-Offs | Closing Balance | 2024 | 2023 Restated |

| Informatics hardware | 335 | 33 | – | 167 | 201 | 307 | 26 | – | 167 | 166 | 35 | 28 |

| Other equipment | 1,124 | – | – | – | 1,124 | 543 | 121 | – | – | 665 | 459 | 581 |

| Leasehold improvements | 1,005 | – | – | – | 1,005 | 837 | 168 | – | – | 1,005 | – | 167 |

| Assets under construction | 4,048 | 2,789 | – | – | 6,837 | – | – | – | – | – | 6,837 | 4,048 |

| Total | 6,512 | 2,822 | – | 167 | 9,167 | 1,687 | 315 | – | 167 | 1,836 | 7,331 | 4,824 |

8. Contractual obligations

The nature of NSIRA Secretariat’s activities may result in some large multi-year contracts and obligations whereby the Department will be obligated to make future payments in order to carry out its programs or when the services/goods are received. Significant contractual obligations that can be reasonably estimated are summarized as follows:

| 2025 | 2026 | 2027 | 2028 | 2029 | 2030 and subsequent | Total | |

|---|---|---|---|---|---|---|---|

| Acquisition of goods and services | 3,054 | 45 | 45 | 45 | – | – | 3,189 |

| Total | 3,054 | 45 | 45 | 45 | – | – | 3,189 |

9. Related party transactions

NSIRA is related as a result of common ownership to all government departments, agencies, and Crown corporations. Related parties also include individuals who are members of key management personnel or close family members of those individuals, and entities controlled by, or under shared control of, a member of key management personnel or a close family member of that individual.

NSIRA enters into transactions with these entities in the normal course of business and on normal trade terms.

During the year, NSIRA received common services which were obtained without charge for other government departments as disclosed below.

(a) Common services provided without charge by other government departments

During the year, the NSIRA Secretariat received services without charge from certain common service organizations, related to accommodation and the employer’s contribution to the health and dental insurance plans. These services provided without charge have been recorded at the carrying value in NSIRA Secretariat’s Statement of Operations and Departmental Net Financial Position as follows:

(in thousands of dollars)

| 2024 | 2023 | |

|---|---|---|

| Accommodation | 500 | 500 |

| Employer’s contribution to the health and dental insurance plans | 937 | 765 |

| Total | 1,437 | 1,265 |

The Government has centralized some of its administrative activities for efficiency, cost-effectiveness purposes and economic delivery of programs to the public. As a result, the Government uses central agencies and common service organizations so that one department performs services for all other departments and agencies without charge. The costs of these services, such as the payroll and cheque issuance services provided by Public Services and Procurement Canada and audit services provided by the Office of the Auditor General are not included in the Department’s Statement of Operations and Departmental Net Financial Position.

(b) Other transactions with other government departments and agencies

| 2024 | 2023 | |

|---|---|---|

| Expenses | 6,816 | 7,324 |

10. Segmented information

Presentation by segment is based on the Department’s core responsibility. The presentation by segment is based on the same accounting policies as described in the Summary of significant accounting policies in Note 2. The following table presents the expenses incurred and revenues generated for the main core responsibilities, by major object of expense and by major type of revenue. The segment results for the period are as follows:

| National Security and Intelligence Reviews and Complaints Investigations | Internal Services | 2023 | 2022 | |

|---|---|---|---|---|

| Expenses | ||||

| Salaries and employee benefits | 7,817 | 3,200 | 11,017 | 10,282 |

| Professional and special services | 250 | 3,422 | 3,672 | 3,470 |

| Accommodation | – | 519 | 519 | 505 |

| Transportation and communications | 226 | 138 | 364 | 213 |

| Information | 4 | 13 | 17 | 69 |

| Acquisition of machinery and equipment | – | 47 | 47 | 354 |

| Repair and maintenance | – | 3,643 | 3,643 | 3,091 |

| Amortization of tangible capital assets | – | 664 | 664 | 528 |

| Rental | – | 215 | 215 | 130 |

| Utilities, materials and supplies | 2 | 37 | 39 | 30 |

| Other | 60 | (671) | (611) | (2,507) |

| Total expenses | 8,359 | 11,227 | 19,586 | 16,165 |

| Net cost from continuing operations | 8,359 | 11,227 | 19,586 | 16,165 |

Annex to the Statement of Management Responsibility Including Internal Control over Financial Reporting for Fiscal Year 2021-22 (unaudited)

1. Introduction

This document provides summary information on measures taken by the National Security and Intelligence Review Agency (NSIRA) Secretariat to maintain an effective system of internal control over financial reporting (ICFR) including information on internal control management, assessment results and related action plans.

Detailed information on NSIRA Secretariat’s authority, mandate, and programs can be found in our Departmental Plan for the 2024 to 2025 fiscal year and our Departmental Results Report for the 2023 to 2024 fiscal year.

2. Departmental system of internal control over financial reporting

In support of an effective system of internal control, NSIRA Secretariat conducted self-assessments of key control areas that were identified to be assessed in the 2023 to 2024 fiscal year. A summary of the assessment results and action plan is provided in subsection B.2.

NSIRA Secretariat completed the assessment of key control areas as indicated in the following table. A summary of the results, action plans, and additional details are also provided.

2.1 Service Arrangements relevant to financial statements

NSIRA Secretariat relies on other organizations for the processing of certain transactions that are recorded in its financial statements and relies on these service providers to ensure an adequate system of ICFR is maintained over services provided to NSIRA Secretariat.

Common Arrangements:

- Public Services and Procurement Canada, which administers the payment of salaries and the procurement of goods and services, and provides accommodation services

- Shared Services Canada, which provides IT infrastructure services

- Treasury Board of Canada Secretariat, which provides information on public service insurance and centrally administers payment of the employer’s share of contributions toward statutory employee benefit plans

Readers of this simplified annex may refer to the annexes of the above-noted departments for a greater understanding of the systems of internal control over financial reporting related to these specific services.

Specific Arrangements:

- Prior to fiscal 2021-22, in accordance with a Memorandum of Understanding (MOU) between the two organizations, NSIRA Secretariat relied on the Privy Council Office (PCO) for the performance of financial services, including relevant control measures. Effective, April 1, 2021, NSIRA Secretariat entered into a new MOU with PCO, which reflected a shift whereby NSIRA Secretariat repatriated its financial services to capacity in fiscal year 2022-23.

- Treasury Board of Canada Secretariat provides the Secretariat with a SAP financial system platform to capture and report all financial transactions and a PeopleSoft human resources system platform to manage pay and leave transactions.

2.2 Assessment results for the 2022 to 2023 fiscal year

NSIRA Secretariat completed the assessment of key control areas as indicated in the following table. A summary of the results, action plans, and additional details are also provided.

| Key Control Areas | Remediation required | Summary results and action plan |

|---|---|---|

| Contracting | No | Internal controls are functioning as intended, no action plan required. |

| Year-end Payables | N/A | Not applicable |

| Receivables | N/A | Not applicable |

With respect to the key control areas of contracting, controls were functioning well and form an adequate basis for the department’s system of internal control.

3. Departmental action plan

Assessment Plan

NSIRA will assess the performance of its system of internal control by focusing on key control areas over a cycle of years as shown in the following table.

| Key Control Areas | 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 |

|---|---|---|---|---|---|

| Delegation | Yes | No | No | No | No |

| Transfer Payments | Yes | No | No | No | No |

| Contracting | No | Yes | No | No | No |

| Year-end Payables | No | Yes | No | No | No |

| Receivables | No | Yes | No | No | No |

| Pay Administration | No | No | Yes | No | No |

| Travel | No | No | No | Yes | No |

| Financial Management Governance | No | No | Yes | No | No |

| Hospitality | No | No | No | Yes | No |

| Fleet Management | No | No | No | Yes | No |

| Accountable Advances | No | No | No | Yes | No |

| Acquisition cards | No | No | No | No | Yes |

| Leave | No | No | No | No | Yes |

| Special Financial Authorities | No | No | No | No | Yes |