Date of Publishing:

Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Report. This quarterly financial report should be read in conjunction with the 2020- 21 Main Estimates.

A summary description of the National Security and Intelligence Review Agency Secretariat (NSIRA) program activities can be found in Part II of the Main Estimates. For information on the mandate of NSIRA, please visit its website at http://www.nsira-ossnr.gc.ca.

This quarterly report has not been subject to an external audit or review.

Mandate

The National Security and Intelligence Review Agency (NSIRA) is an independent external review body, which reports to Parliament. NSIRA was established in July of 2019 and is responsible to conduct reviews of the Government of Canada national security and intelligence activities to ensure that they are lawful, reasonable and necessary. NSIRA also hears public complaints regarding key national security agencies and activities. NSIRA replaces the Security Intelligence Review Committee (SIRC), which reviewed CSIS (Canadian Security Intelligence Service) activities as well as those related to the revocation or denial of security clearances. Going forward, it will also hear complaints regarding the Communication Security Establishment (CSE), as well as national security-related complaints regarding the RCMP.

Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the department’s spending authorities granted by Parliament and those used by the department, consistent with the 2020-21 Main Estimates. This quarterly report has been prepared using a special purpose financial reporting framework (cash basis) designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

Highlights of the fiscal quarter and fiscal year-to-date results

This section highlights the significant items that contributed to the net increase or decrease in authorities available for the year and actual expenditures for the quarter ended June 30, 2020.

NSIRA spent approximately 5% of its authorities by the end of the first quarter, compared to 15% in the same quarter of 2019-20 (see graph 1 below).

Graph 1: Comparison of total authorities and total net budgetary expenditures, Q1 2020–21 and Q1 2019–20

Text version of Figure 1

| 2020-21 | 2019-20 | |

|---|---|---|

| Total Authorities | $24.3 | $5.2 |

| Q1 Expenditures | $1.2 | $0.8 |

Significant changes to authorities

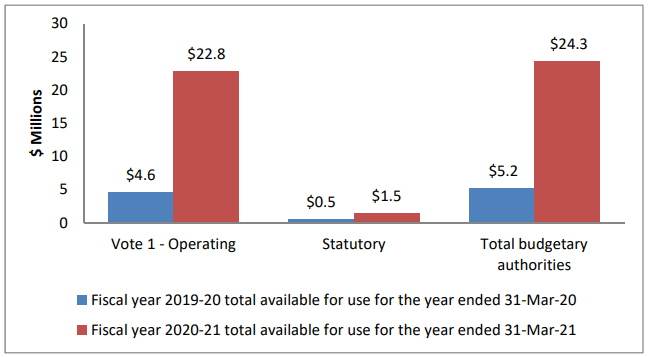

As per graph 2 below as at June 30, 2020, NSIRA had authorities available for use of $24.3 million in 2020-21 compared to $5.2 million as of June 30, 2019, for a net increase of $19.1 million or 367%.

Graph 2: Variance in authorities as at June 30, 2020

Text version of Figure 2

| Fiscal year 2019-20 total available for use for the year ended March 31, 2020 | Fiscal year 2020-21 total available for use for the year ended March 31, 2021 | |

|---|---|---|

| Vote 1 – Operating | $4.6 | $22.8 |

| Statutory | $0.5 | $1.5 |

| Total budgetary authorities | $5.2 | $24.3 |

The authorities’ increase of $19.1 million is explained by the approval of funding for the mandate of NSIRA. A portion of the increase, $5.0 M, is to be used to initiate temporary and permanent accommodation projects.

Significant changes to quarter expenditures

Year-to-date expenditures recorded to the end of the first quarter totaled $1.2M for an increase of $0.4M when compared to $0.8M spent during the same period in 2019-20. Table 1 below presents budgetary expenditures by standard object. The authorities’ increase of $19.1 million is explained by the approval of funding for the mandate of NSIRA. A portion of the increase, $5.0 M, is to be used to initiate temporary and permanent accommodation projects.

Table 1

(in thousands of dollars)

| Material Variances to Expenditures by Standard Object | YTD Expenditures as of June 30, 2020 | YTD Expenditures as of June 30, 2019 | Variance $ | Variance % |

|---|---|---|---|---|

| Personnel | 1,111 | 548 | 563 | 103% |

| Transportation and communications | 7 | 30 | (23) | (77%) |

| Information | 50 | 4 | 46 | 1150% |

| Professional and special services | 68 | 87 | (19) | (22%) |

| Rentals | 0 | 25 | (25) | (100%) |

| Repair and maintenance | 0 | 1 | (1) | (100%) |

| Utilities, materials and supplies | 9 | 3 | 6 | 200% |

| Acquisition of machinery and equipment | 0 | 5 | (5) | (100%) |

| Other subsidies and payment | 0 | 97 | (97) | (100%) |

| Total gross budgetary expenditures | 1,246 | 801 | 445 | 56% |

Personnel

The increase of $563,000 is mainly related to staffing to support new departmental mandate.

Transportation and communications

The decrease of $23,000 is mainly explained by lack of travel due to COVID-19 pandemic.

Information

The increase of $46,000 is explained by higher expenditures for electronic subscriptions.

Professional and special services

The decrease of $19,000 is mainly due to the timing of the invoices for Translation.

Rentals

The decrease of $25,000 is mostly explained by the timing of the invoices as well as lower expenditures on rentals due to the pandemic.

Utilities, Materials and Supplies

The increase of $6,000 is mostly due an increase in spending for material and supplies.

Acquisition of machinery and equipment

The decrease of $5,000 is mainly explained by delays in acquisitions due to the pandemic.

Other Subsidies and payments

The decrease of $97,000 is due to multiple Salary Overpayments processed in first quarter of 2019-20.

Risks and uncertainties

The COVID-19 Pandemic had a significant impact on the ability of NSIRA to grow its organization in a way that is commensurate with its new mandate. The physical distancing requirements decreased the ability of staff to concurrently work with departments and agencies subject to reviews. In light of that, NSIRA revised its Review Plan and has advanced the introduction of a new approach to the review of complaints.

The ability to hire a sufficient number of qualified personnel within relevant timelines remains a short- and medium-term risk for NSIRA, particularly given the specialized knowledge and skillsets required for many positions. This is further compounded by the requirement for candidates to obtain a Top Secret security clearance, which can incur significant delays, especially during the Pandemic.

While NSIRA has been able to secure temporary space to address its immediate space requirements, the timing at which this staff will be able to operate within this high security zone has still not been determined. NSIRA is working closely with Public Services and Procurement Canada to expedite the fit-up plans.

The ability of NSIRA to access the information it needs to do its work and speak to the relevant internal stakeholders to understand policies, operations and ongoing issues is closely tied to the reviewed departments’ capacity to respond to the demands of NSIRA. The Pandemic impacts and existing resource constraints of the reviewed departments could delay NSIRA’s ability to deliver on its mandate in a timely way.

NSIRA is closely monitoring pay transactions to identify and address over and under payments in a timely manner and continues to apply ongoing mitigating controls, which were implemented in 2016.

Mitigation measures for the risks outlined above have been identified and are factored into NSIRA’s approach to the conduct of its mandate.

Significant changes in relation to operations, personnel and programs

The Pandemic forced some changes in the way NSIRA’s conducts operations. The requirement for physical distancing and the existing challenge with respect to high security zone accommodation has led NSIRA to authorize staff to work with nonsensitive files from home.

There have been no new Governor-in-Council appointments during the first quarter. Charles Fugere has been named new Senior General Counsel with NSIRA.

There have been no changes to the NSIRA Program.

Approved by senior officials:

John Davies

Executive Director

Pierre Souligny

Senior Director, Corporate Services, Chief Financial Officer

Appendix

Statement of authorities (Unaudited)

(in thousands of dollars)

| Fiscal year 2020–21 | Fiscal year 2019–20 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2021 (note 1) | Used during the quarter ended June 30, 2020 | Year to date used at quarter-end | Total available for use for the year ending March 31, 2020 (note 1) | Used during the quarter ended June 30, 2019 | Year to date used at quarter-end | |

| Vote 1 – Net operating expenditures | 22,801 | 875 | 875 | 4,629 | 670 | 670 |

| Budgetary statutory authorities | ||||||

| Contributions to employee benefit plans | 1,484 | 371 | 371 | 526 | 131 | 131 |

| Total budgetary authorities (note 2) | 24,285 | 1,246 | 1,246 | 5,155 | 801 | 801 |

Note 1: Includes only authorities available for use and granted by Parliament as at quarter-end.

Note 2: Details may not sum to totals due to rounding.

Departmental budgetary expenditures by standard object (unaudited)

(in thousands of dollars)

| Fiscal year 2020–21 | Fiscal year 2019–20 | |||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2021 (note 1) | Expended during the quarter ended June 30, 2020 | Year to date used at quarter-end | Planned expenditures for the year ending March 31, 2020 | Expended during the quarter ended June 30, 2019 | Year to date used at quarter-end | |

| Expenditures | ||||||

| Personnel | 11,510 | 1,111 | 1,111 | 3,962 | 548 | 548 |

| Transportation and communications | 1,162 | 7 | 7 | 232 | 30 | 30 |

| Information | 364 | 50 | 50 | 76 | 4 | 4 |

| Professional and special services | 3,250 | 68 | 68 | 265 | 87 | 87 |

| Rentals | 237 | 0 | 0 | 70 | 25 | 25 |

| Repair and maintenance | 7,134 | – | – | 4 | 1 | 1 |

| Utilities, materials and supplies | 173 | 9 | 9 | 29 | 3 | 3 |

| Acquisition of machinery and equipment | 393 | – | – | 315 | 5 | 5 |

| Other subsidies and payments | 63 | – | – | 2 | 97 | 97 |

| Total gross budgetary expenditures (note 2) |

24,285 | 1,246 | 1,246 | 5,155 | 801 | 801 |

Note 1: Includes only authorities available for use and granted by Parliament as at quarter-end.

Note 2: Details may not sum to totals due to rounding.