- Introduction

- Mandate

- Basis of presentation

- Highlights of the fiscal quarter and fiscal year-to-date results

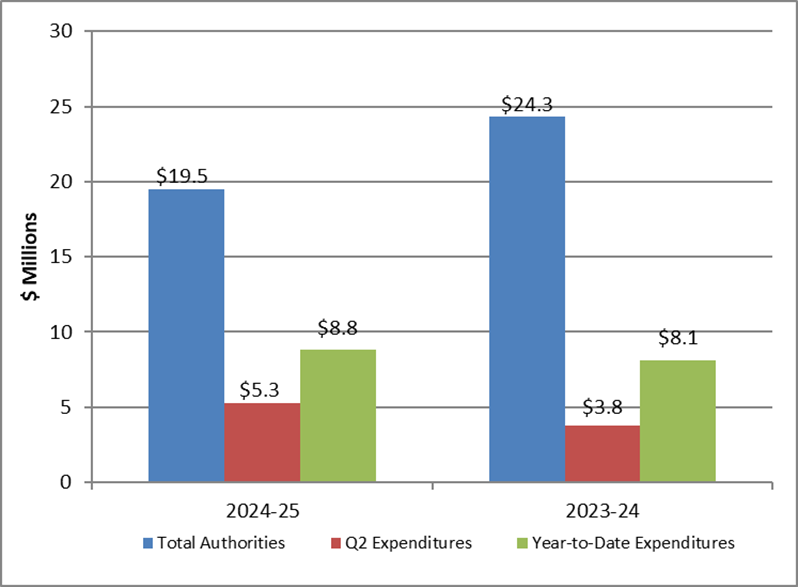

- Graph 1: Comparison of total authorities and total net budgetary expenditures, Q2 2024–2025 and Q2 2023–2024 (in millions of dollars)

- Significant changes to authorities

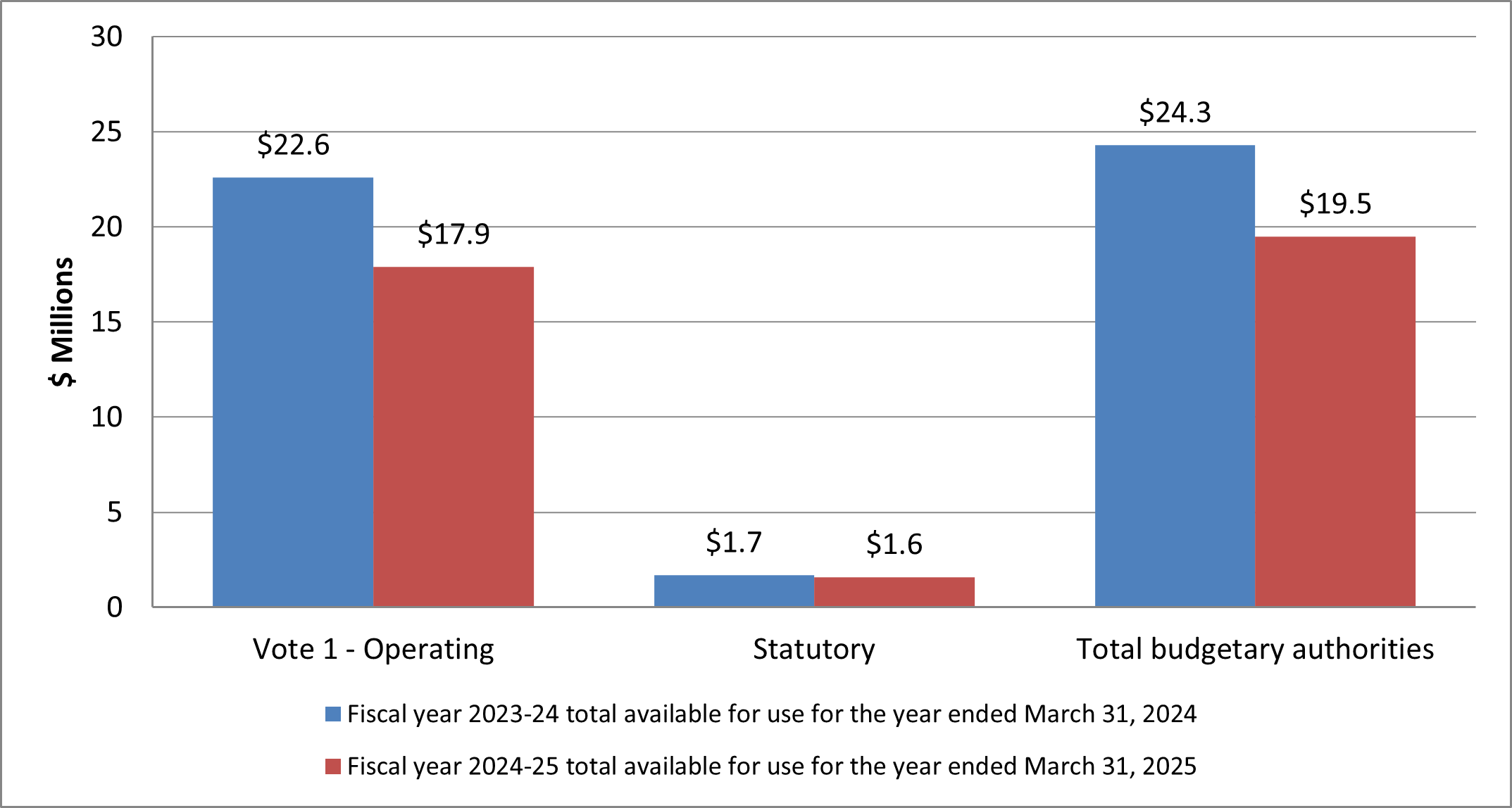

- Graph 2: Variance in authorities as of September 30, 2024 (in millions of dollars)

- Significant changes to quarter expenditures

- Significant changes to year-to-date expenditures

- Risks and uncertainties

- Significant changes in relation to operations, personnel and programs

- Approved by senior officials:

- Appendix

Date of Publishing:

Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Report. This quarterly financial report should be read in conjunction with the 2024–2025 Main Estimates.

This quarterly report has not been subject to an external audit or review.

Mandate

The National Security and Intelligence Review Agency (NSIRA) is an independent external review body that reports to Parliament. Established in July 2019, NSIRA is responsible for conducting reviews of the Government of Canada’s national security and intelligence activities to ensure that they are lawful, reasonable and necessary. NSIRA also hears public complaints regarding key national security agencies and their activities.

The NSIRA Secretariat supports the Agency in the delivery of its mandate. Independent scrutiny contributes to strengthening the accountability framework for national security and intelligence activities and to enhancing public confidence. Ministers and Canadians are informed whether national security and intelligence activities undertaken by Government of Canada institutions are lawful, reasonable, and necessary

A summary description NSIRA’s program activities can be found in Part II of the Main Estimates. Information on NSIRA’s mandate can be found on its website.

Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the agency’s spending authorities granted by Parliament and those used by the agency, consistent with the 2024–2025 Main Estimates. This quarterly report has been prepared using a special-purpose financial reporting framework (cash basis) designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authorities for specific purposes.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of the fiscal quarter and fiscal year-to-date results

This section highlights the significant items that contributed to the net increase or decrease in authorities available for the year and actual expenditures for the quarter ended September 30, 2024.

NSIRA Secretariat spent approximately 45% of its authorities by the end of the second quarter, compared with 33% in the same quarter of 2023–2024 (see graph 1).

Graph 1: Comparison of total authorities and total net budgetary expenditures, Q2 2024–2025 and Q2 2023–2024 (in millions of dollars)

Text version of Figure 1

| 2024-25 | 2023-24 | |

|---|---|---|

| Total Authorities | $19.5 | $24.3 |

| Q2 Expenditures | $5.3 | $3.8 |

| Year-to-Date Expenditures | $8.8 | $8.1 |

Significant changes to authorities

As of September 30, 2024, Parliament had approved $19.5 million in total authorities for use by NSIRA Secretariat for 2024–2025 compared with $24.3 million as of September 30, 2023, for a net decrease of $4.8 million or 19.8% (see graph 2).

Graph 2: Variance in authorities as of September 30, 2024 (in millions of dollars)

Text version of Figure 2

| Fiscal year 2023-24 total available for use for the year ended March 31, 2024 | Fiscal year 2024-25 total available for use for the year ended March 31, 2025 | |

|---|---|---|

| Vote 1 – Operating | 22.6 | 17.9 |

| Statutory | 1.7 | 1.6 |

| Total budgetary authorities | 24.3 | 19.5 |

*Details may not sum to totals due to rounding*

The decrease of $4.8 million in authorities is mostly explained by a reduction in capital funding for infrastructure projects due to the fact that they have reached completion in this fiscal year.

Significant changes to quarter expenditures

The second quarter expenditures totalled $5.3 million for an increase of $1.5 million when compared with $3.8 million spent during the same period in 2023–2024. Table 1 presents budgetary expenditures by standard object.

Table 1: Departmental budgetary expenditures by Standard Object (unaudited)

| Variances in expenditures by standard object (in thousands of dollars) | Fiscal year 2024–25: expended during the quarter ended September 30, 2024 | Fiscal year 2023–24: expended during the quarter ended September 30, 2023 | Variance $ | Variance % |

|---|---|---|---|---|

| Personnel | 3,856 | 3,014 | 842 | 28% |

| Transportation and communications | 77 | 62 | 15 | 24% |

| Information | 7 | 4 | 3 | 75% |

| Professional and special services | 1,320 | 504 | 816 | 162% |

| Rentals | 17 | 25 | (8) | (32%) |

| Repair and maintenance | 37 | 3 | 34 | 1133% |

| Utilities, materials, and supplies | 12 | 50 | (38) | (76%) |

| Acquisition of machinery and equipment | 8 | 4 | 4 | 100% |

| Other subsidies and payments | (38) | 118 | (156) | (132%) |

| Total gross budgetary expenditures | 5,296 | 3,784 | 1,512 | 40% |

Personnel

The increase of $842,000 reflects management’s decision to increase FTEs to enhance operational capacity in response to greater demand for output. It is also a result of an increase in average salary due to alignment with increases approved as part of collective bargaining.

Professional and special services

The increase of $816,000 is mainly explained by a change in the timing of the billing for maintenance and services in support of our classified IT network infrastructure.

Repair and maintenance

The increase of $34,000 is explained by some one-time office repairs in fiscal year 2024-2025.

Utilities, materials, and supplies

The decrease of $38,000 is explained by temporarily unreconciled acquisition card purchases in fiscal year 2023-2024.

Other subsidies and payments

The decrease of $156,000 is explained by an increase in the recovery of salary overpayments.

Significant changes to year-to-date expenditures

The year-to-date expenditures totalled $8.8 million for an increase of $0.7 million (8%) when compared with $8.1 million spent during the same period in 2023-2024. Table 2 presents budgetary expenditures by standard object.

Table 2: Departmental budgetary expenditures by Standard Object (unaudited) (continued)

| Variances in expenditures by standard object (in thousands of dollars) | Fiscal year 2024–25: year-to-date expenditures as of September 30, 2024 | Fiscal year 2023–24: year-to-date expenditures as of September 30, 2023 | Variance $ | Variance % |

|---|---|---|---|---|

| Personnel | 6,864 | 5,900 | 964 | 16% |

| Transportation and communications | 135 | 192 | (57) | (30%) |

| Information | 13 | 4 | 9 | 225% |

| Professional and special services | 1,589 | 1,669 | (80) | (5%) |

| Rentals | 42 | 73 | (31) | (42%) |

| Repair and maintenance | 40 | 27 | 13 | 48% |

| Utilities, materials and supplies | 40 | 57 | (17) | (30%) |

| Acquisition of machinery and equipment | 20 | 52 | (32) | (62%) |

| Other subsidies and payments | 41 | 122 | (81) | (66%) |

| Total gross budgetary expenditures | 8,784 | 8,096 | 688 | 8% |

Transportation and communications

The decrease of $57,000 is due to the timing of invoicing for the organization’s Network Services.

Information

The increase of $9,000 is due to the timing of invoicing for printing services.

Acquisition of machinery and equipment

The decrease of $32,000 is mainly explained by the one-time purchase of a specialized laptop in 2023-2024.

Other subsidies and payments

The decrease of $81,000 is mainly explained by higher leasehold improvement amortization expenses in 2023-2024.

Risks and uncertainties

There is a risk that the funding received to offset pay increases will be insufficient to cover the costs of such increases and the year-over-year cost of services provided by other government departments/agencies is increasing significantly. To mitigate, NSIRA Secretariat is forecasting both personnel and operating expenditures three fiscal years out and identifying critical functions.

NSIRA Secretariat is closely monitoring pay transactions to identify and address over and under payments in a timely manner. It continues to apply ongoing mitigating controls such as participating in PSPC’s Reconciliation Tool (RT) initiative.

Mitigation measures for the risks outlined above have been identified and are factored into NSIRA Secretariat’s approach and timelines for the execution of its mandated activities.

Significant changes in relation to operations, personnel and programs

Mr. Charles Fugère was appointed by the Governor-in-Council to be Executive Director of the NSIRA Secretariat, for a period of three years, on July 27, 2024.

Approved by senior officials:

Charles Fugère

Executive Director

Martyn Turcotte

Chief Financial Officer

Appendix

Statement of authorities (Unaudited)

(in thousands of dollars)

| Fiscal year 2024–25 | Fiscal year 2023–24 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2025 (note 1) | Used during the quarter ended September 30, 2024 | Year to date used at quarter-end | Total available for use for the year ending March 31, 2024 (note 1) | Used during the quarter ended September 30, 2023 | Year to date used at quarter-end | |

| Vote 1 – Net operating expenditures | 17,857 | 4,895 | 7,983 | 22,564 | 3,345 | 7,218 |

| Budgetary statutory authorities | ||||||

| Contributions to employee benefit plans | 1,601 | 401 | 801 | 1,755 | 439 | 878 |

| Total budgetary authorities (note 2) | 19,458 | 5,296 | 8,784 | 24,319 | 3,784 | 8,096 |

Note 1: Includes only authorities available for use and granted by Parliament as at quarter-end.

Note 2: Details may not sum to totals due to rounding.

Departmental budgetary expenditures by standard object (unaudited)

(in thousands of dollars)

| Fiscal year 2024–25 | Fiscal year 2023–24 | |||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2025 (note 1) | Expended during the quarter ended September 30, 2024 | Year-to-date used at quarter-end | Planned expenditures for the year ending March 31, 2024 | Expended during the quarter ended September 30, 2023 | Year-to-date used at quarter-end | |

| Expenditures | ||||||

| Personnel | 13,205 | 3,856 | 6,864 | 13,303 | 3,014 | 5,900 |

| Transportation and communications | 685 | 77 | 135 | 650 | 62 | 192 |

| Information | 76 | 7 | 13 | 371 | 4 | 4 |

| Professional and special services | 4,624 | 1,320 | 1,589 | 4,906 | 504 | 1,669 |

| Rentals | 309 | 17 | 42 | 271 | 25 | 73 |

| Repair and maintenance | 436 | 37 | 40 | 4,580 | 3 | 27 |

| Utilities, materials, and supplies | 58 | 12 | 40 | 73 | 50 | 57 |

| Acquisition of machinery and equipment | 65 | 8 | 20 | 132 | 4 | 52 |

| Other subsidies and payments | 0 | (38) | 41 | 33 | 118 | 122 |

| Total gross budgetary expenditures (note 2) |

19,458 | 5,296 | 8,784 | 24,319 | 3,784 | 8,096 |

Note 1: Includes only authorities available for use and granted by Parliament as at quarter-end.

Note 2: Details may not sum to totals due to rounding.